Out of the many great technological breakthroughs that have happened to date in the digital arena, blockchain-backed cryptocurrency is the greatest of all. From barter system to paper currency, we had thought it was one of the greatest revolutions of mankind but who knew the story wasn't over yet. And then one fine morning, we heard someone mumbling the phrase "cryptocurrency."

In plain words, cryptocurrency is a digital asset. The name originates from the fact that all of its transactions are highly encrypted, making the transaction highly secure. It is decentralized in nature, a medium of exchange at a peer-to-peer level unlike traditional currencies, which are managed and controlled by a central authority. Cryptocurrencies are calculative in number and at times equated to precious metals like gold and silver. The key to this vision lies in blockchain technology which in itself is no less than a miracle. It acts like a public ledger, that records every transaction, detailing the amount as well as the sender and receiver’s wallet addresses.

The total worth of the cryptocurrency market as of Nov 2021 is a whopping $2.9 trillion. There are over 10,000 listed cryptocurrencies at the time of writing, and this number is only bound to increase in the coming times. Today, bitcoin is the majesty of all in terms of market capitalization. Let's start from scratch. First, you have to keep in mind that cryptocurrencies are not physical assets, they are clippings of computer code that transfer value from one user to another. These currencies are created using encryption algorithms. The use of encryption technologies means that cryptocurrencies function both as a currency and as a virtual accounting system. To use them, you need a cryptocurrency wallet. These wallets can be software that is a cloud-based service or is stored on your computer or on your mobile device. The wallets are the tool through which you store your encryption keys that confirm your identity and link to your cryptocurrency. Let's take the example of bitcoin. When you sign to verify that you wish to send the bitcoin, you generate a small personalized piece of code attached to the transaction, and the system creates a mathematical puzzle that locks up that value and scrambles the code. When the recipient wants to spend that money, they would put a corresponding piece of code that would fit the original one. This process of fitting the codes together is mining and the entire operation is called signature verification.

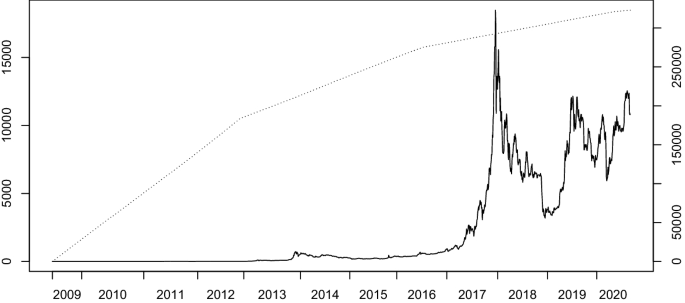

In the initial phase, bitcoin was a gold rush of opportunity. Bitcoin had a price of nearly zero when it was introduced in 2009. On July 17, 2010, its price jumped to $.09. Since then, it is rising and rising and touching the skies. From $1 in 2011 to $68,000 in 2021, it has seen stellar growth and emerged as a new asset class alternative to Gold and Silver. No wonder, Forbes had once recommended it to be the best investment of the time.

In one word: Growth. Investors are intrigued by the potential of cryptocurrency to grow in value — as well as the potential transformation of the financial system that crypto might bring. People have seen so much downfall and saturation in the alternative investments such as Gold, silver, bond, and debt market, that now they look for options that have a high potential. Some investors look at crypto mainly bitcoin as an inflation hedge and this view has invoked interest even from institutions. Cryptocurrencies and the underlying blockchain technology have spurred up innovation with various use-cases such as Decentralized Finance (Defi), new channels for global transactions with smart contracts, Non-fungible tokens (NFTs), Metaverse, etc. Though this industry is still largely unregulated, yet there is a lot going on in this industry. Most governments across the world are planning to come up with regulations that promote this fintech innovation.

Now as you know what crypto is, there might be a lot of questions popping up in your mind. How does cryptocurrency work? What is the science behind it? How is it linked to blockchain? Don't worry. We've got you covered! Check out our learn page.